Taking a More Representative Look at Energy

The energy sector isn’t what it was 15 years ago. For decades, energy investing meant gaining exposure to oil prices, typically through concentrated positions in a handful of large-cap producers or high-beta indexes.

Today’s energy sector is broader in scope, more income-oriented, and far more complex than in years past. What was once a concentrated crude oil trade evolved into a diverse ecosystem of real assets—spanning natural gas, natural gas liquids (NGLs), utilities, liquefied natural gas (LNG) terminals, pipelines, and export infrastructure. As the U.S. solidifies its position as the world’s leading energy producer and exporter, these assets are increasingly vital to meeting global power and industrial demand. Yet, we feel many investment solutions haven’t kept up.

Most energy offerings remain narrowly focused, heavily weighted toward oil producers or sector-only exposure, with little flexibility to adapt as macro and sector dynamics shift. Others carry structural limitations such as double taxation (C-Corp Master Limited Partnership (MLP) funds) or modest income potential due to their index constraints.

It’s time for what we feel is a more representative, modern approach to energy investing that reflects where the market may be headed.

TNGY: Built for What Energy Has Become

The Tortoise Energy Fund (TNGY) is designed to meet this moment. TNGY is an actively managed ETF that seeks to deliver high, tax-efficient income through a flexible strategy spanning the full energy value chain: from producers to pipelines, utilities to LNG terminals, and the infrastructure that powers the global economy. Traditional oil exposure remains part of the portfolio, but is balanced by a broader focus on midstream, utilities, and export-related assets that reflect energy's evolution.

At its core, TNGY aims to deliver three investor priorities:

1. Income

TNGY targets a competitive distribution yield through a mix of equity dividends, energy-related credit, and covered call income. The ETF issues a 1099 (no K-1s) and is RIC-qualified, avoiding the double tax burden of C-Corp structures.

2. Diversification

TNGY provides balanced exposure across the energy value chain—including upstream, midstream, downstream, power, and utilities—offering a broader, more stable profile than oil-heavy sector funds.

3. Flexibility

The fund can shift between equity and fixed income, overweight sectors as opportunities arise, and reduce the exposure to rate-sensitive assets when conditions change. Recent updates to the prospectus allow fixed income exposure to move between 0–50%, enhancing adaptability across full market cycles.

Responding to Long-Term Trends –

We believe two defining themes will shape the next decade:

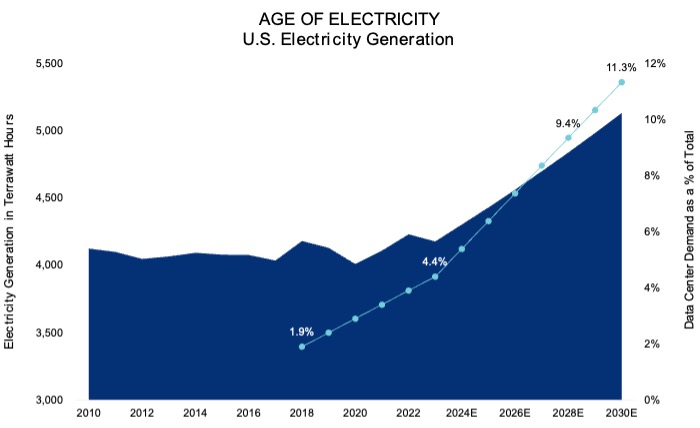

- The “Age of Electricity” driven by data center growth, electrification, and grid modernization.

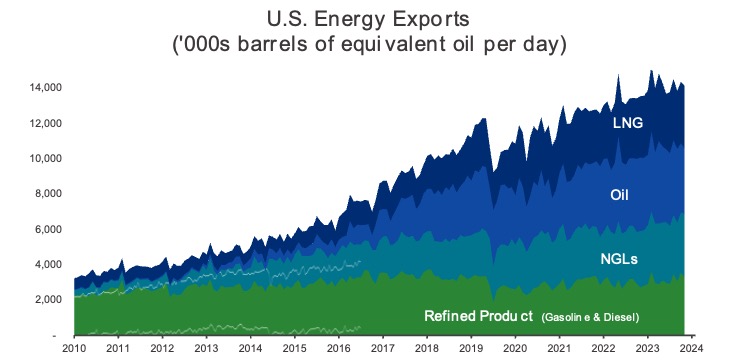

- Rising Natural Gas and NGL demand as globally scalable, lower-emission fuels anchor U.S. energy exports.

Source: Energy Information Administration and Department of Energy as of 12/31/2024

Source: Energy Information Administration as of January 31, 2025

Over the past decade, the U.S. energy market underwent a historic transformation, moving from importer to exporter. The lifting of the crude oil export ban in 2015 and the repurposing of LNG import terminals into export hubs enabled U.S. producers and infrastructure operators to meet rising demand for reliable, cleaner fuels globally - not just domestically. The customers for U.S. energy are now international, and growth around natural gas and NGL exports is a long-term structural driver of growth within the sector.

TNGY is positioned at the center of these megatrends, holding companies critical to the movement, storage, and monetization of energy across global markets. The fund invests in the businesses making the U.S. the world’s largest energy producer and exporter.

Why TNGY Now?

TNGY reflects the attributes investors expect in a modern active ETF:

Designed for high, tax-efficient Income – Delivered via 1099s, with potential for enhanced yield from covered calls and credit

Designed for high, tax-efficient Income – Delivered via 1099s, with potential for enhanced yield from covered calls and credit

Seeking Real Asset Inflation Protection – Focused on infrastructure with inflation-linked, fee-based revenue

Seeking Real Asset Inflation Protection – Focused on infrastructure with inflation-linked, fee-based revenue

Intra-day Liquidity – Daily tradability with full transparency

Intra-day Liquidity – Daily tradability with full transparency

Cost Competitiveness – Recently lowered to offer greater value and competitiveness relative to legacy energy mutual funds and C-Corp ETFs

Cost Competitiveness – Recently lowered to offer greater value and competitiveness relative to legacy energy mutual funds and C-Corp ETFs

Importantly, the portfolio team behind TNGY managed energy strategies through every major sector downturn of the past 15 years, including the 2008 global financial crisis, the 2014–2016 oil collapse, the COVID-driven crash of 2020, and multiple commodity and interest rate shocks. Throughout, the team remained focused on cash-generative infrastructure, disciplined risk management, and delivering income without excessive drawdown. TNGY is excited to bring that proven process into a modern, actively managed ETF structure.

Where TNGY May Fit in a Portfolio

TNGY can serve multiple roles for advisors and investors:

- Income Sleeve – Provides exposure to income-generating real assets.

- Sector Diversifier – Complements existing energy funds or oil exposure with broader reach.

- Real Asset Allocation – Can offer inflation protection, as many companies benefit from rising commodity prices and inflation-linked cash flows.

- Strategic Thematic Play – Accesses structural growth themes in natural gas, power, and global exports.

Conclusion: A Better Option for Modern Energy Investing

This isn’t your grandfather’s energy sector. It’s a forward-looking, income-focused option for portfolios seeking real assets, structural yield, and resilience in a changing world. Energy investing is no longer just about oil. It’s about income, infrastructure, and global connectivity. The sector evolved. It is now becoming cleaner, more reliable, and more central to powering the modern economy. TNGY offers investors a way to access this shift—actively, strategically, and with a focus on what matters most: flexibility, diversification, and income.

TNGY: A Modern Energy Solution for a Changing Energy Market